Web3 Fundraising Done Right: Get Yourself Funded

Web3 fundraising reached $1.61 billion across 222 deals in Q3 2023 alone.

These numbers look impressive at first glance. The reality shows investment levels dropped to one-third compared to Q2 and fell by three-quarters from Q3 2022. The right projects still find plenty of opportunities. Blockchain development remains the investor favorite, attracting $515 million, about one-third of all invested funds in Q3 2023.

Several success stories shine through this evolving digital world. AltLayer secured $15 million in Series A funding. Argus Labs and CryptoGPT each raised $10 million to fuel their ventures. Modern web3 startups can now tap into more funding channels than ever before. Some need technical expertise while others rely on building strong relationships.

Success depends on a deep grasp of the web3 community and institutional investors' motivations. Consumer applications have dominated fundraising from 2018 to 2024, making up 74% of total deals.

In this article, you'll discover the essentials of securing funding for your web3 project. We'll cover funding options, investor priorities, and pitch preparation. Let's begin!

Web3 Fundraising Options

Web3 fundraising has revolutionized how projects can raise capital beyond traditional finance. Venture capital is the life-blood option, where specialized firms like Pantera Capital and Paradigm give both funding and strategic guidance to blockchain startups. These investors get tokens instead of traditional equity, which creates unique investment dynamics.

Token-based fundraising models have changed by a lot over time.

→ Security Token Offerings (STOs) are regulated investment vehicles that represent ownership in ground assets.

→ Initial Exchange Offerings (IEOs) on established crypto exchanges give immediate access to large user bases and handle compliance requirements.

→ Initial DEX Offerings (IDOs) let communities drive fundraising on platforms like Uniswap.

→ Decentralized Autonomous Organizations (DAOs) have become a powerful funding channel. Projects can get backing through community proposals, while smart contracts manage governance and funds transparently. This approach embodies blockchain's core principle of decentralization.

Major protocols' blockchain ecosystem grants provide non-dilutive capital. Programs like Ethereum Foundation Grants help fund projects that build complementary infrastructure.

Web3-focused accelerators and incubators like Outlier Ventures provide both funding and mentorship.

These methods come with their own benefits, from worldwide accessibility and fewer middlemen to better transparency through immutable ledgers.

What Web3 Investors Look For

Web3 fundraising success depends on what investors want. Institutional investors now prefer structured, yield-oriented products with Bitcoin and Ethereum leading the pack over altcoins. Market volatility drives this fundamental change toward stability.

Smart investors review projects using key factors. Your team composition tops their list. They want balanced expertise in technical development, marketing, and operations. Teams showing blockchain experience and success stories attract potential backers quickly.

Investors carefully examine your project's ground utility and unique features. Projects that generate yield through staking, lending, or DeFi solutions get more attention than speculative ventures.

‼️ Your project needs to solve real problems with clear value.

Security stays at the top of investor priorities. Protocol breaches happen often, making rigorous third-party security audits mandatory. Investors gain confidence when you're open about these audits.

Investors track community participation metrics too. Active Discord members, daily users, and transaction volumes matter. Strong community involvement shows market interest and growth potential.

Your tokenomics must show clear utility and value-building mechanisms benefiting users and token holders alike. Well-designed tokenomics give investors faith in your project's future.

Secure and Manage Investment

Your web3 investment preparation needs a solid security foundation. You should take these protective steps before meeting web3 institutional investors:

Get detailed smart contract audits to show your security commitment

Set up clear legal structures, you might need separate entities for development, token management, and governance.

Prepare thorough documentation of tokenomics, roadmaps, and security protocols.

Serious Web3 fundraising relies heavily on due diligence frameworks.

Your framework should cover:

Market Assessment,

Company Evaluation,

Technology Audits,

Business Plan Analysis,

Regulatory Compliance Checks.

The legal arrangements at this stage might include token warrants, SAFTs (Simple Agreements for Future Tokens), or Token Sale Agreements based on your project's stage.

Smart portfolio management becomes your priority after funding. Financial experts suggest keeping crypto exposure to 2-4% in moderate to aggressive growth portfolios while avoiding it in conservative ones. Crypto's potential 70% drawdowns over 12-month periods make regular rebalancing essential.

Token-based projects benefit from multiple-entity structures that provide enhanced legal protection. The development and token management functions work better separately. This setup helps projects move toward decentralization while protecting investors and meeting regulatory requirements.

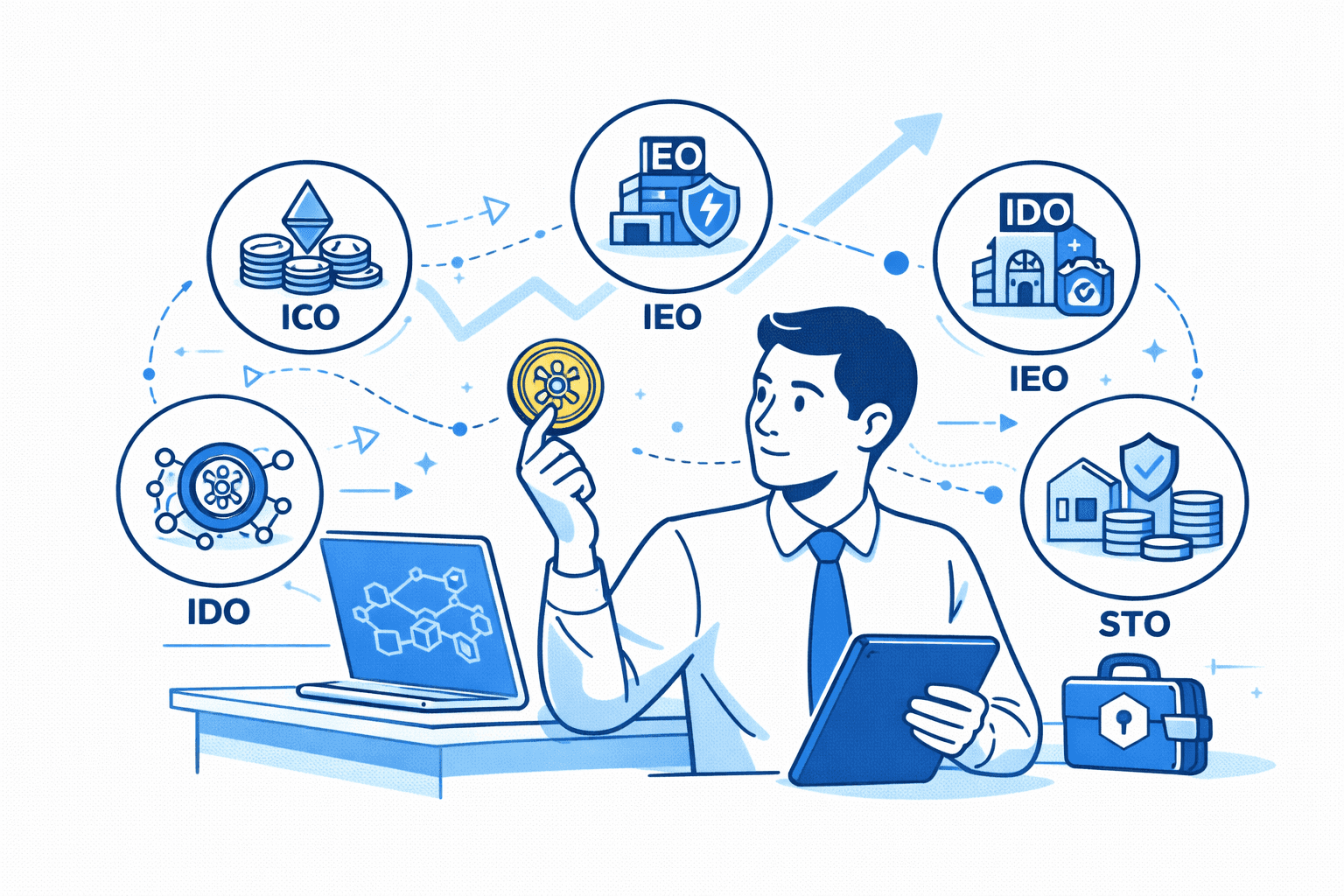

Alternative: Go for Token Sale

Token sales provide a direct path to Web3 fundraising that goes beyond traditional investment channels. The ICOs became the first popular method that let projects raise capital directly from investors without middlemen.

The current token sale world has several evolved models:

ICOs: This original model lets companies give cryptocurrency tokens to participants. Ethereum raised $15.5 million this way in 2014.

IEOs (Initial Exchange Offerings): These take place on exchanges that are 14 years old. They give better security and instant liquidity.

IDOs (Initial DEX Offerings): These launch on decentralized exchanges and provide high liquidity with minimal central control.

STOs (Security Token Offerings): These regulated tokens represent ownership in real-life assets like equity or real estate.

Each model serves a unique purpose. STOs appeal to investors who want compliance, while IDOs match decentralization principles. IEOs solve many early ICO problems because exchanges vet projects and reduce fraud risks.

Projects that want to launch token sales should structure them properly. Their documentation needs clear tokenomics, governance frameworks, and compliance measures. Successful token sales go beyond fundraising. They encourage community involvement and give immediate market access.

Regulatory questions still exist. Yet token-based funding gives global access without diluting ownership. This makes it a perfect fit for projects that focus on decentralized governance.

Conclusion

Web3 fundraising offers great opportunities for innovative projects despite market fluctuations. Projects that show clear utility, strong security measures, and active communities still attract major capital. Investor priorities have shifted toward more structured approaches.

Your fundraising experience needs you to explore multiple paths carefully. You can choose from traditional venture capital, token-based models, DAOs, and ecosystem grants. Each with unique advantages based on your project's needs and stage. Blockchain development remains a prime spot for investment and captures about one-third of all web3 funding.

Understanding what drives investor decisions is crucial for success. Teams that excel in technical development, marketing, and operations stand out from their competitors. Rigorous security protocols, transparent tokenomics, and clear utility have become essential elements of any winning funding pitch.

Good preparation separates funded projects from those that miss the mark. Hardware wallets, detailed smart contract audits, and clear legal structures are the foundations of a solid fundraising approach. These preparations show professionalism and build trust with potential backers.

If your project is serious about scaling visibility and trust through KOL marketing, our team at Disence can help. As the leading Web3 KOL marketing agency, we specialize in ROI-driven KOL campaigns that consistently deliver measurable growth. With access to 1,200+ vetted KOLs across YouTube, Twitter, TikTok, and Telegram, we maintain 91% client retention rate, we know what it takes to make your campaign perform. Book a call with our team to start planning your next Web3 KOL marketing campaign today.

Token sales give projects a powerful way to tap into direct community support without traditional intermediaries. Different models, from ICOs to STOs, serve unique purposes and attract various investor profiles.

The web3 funding climate might have cooled from its peak, but substantial capital flows to worthy projects. Your project can join successfully funded web3 ventures with the right approach, security practices, and grasp of investor priorities.