From E-Commerce to On-Chain Ownership: Exploring BeToken.

People interested in tokenization might have realized something over time. There’s a lot of noise about using blockchain for “real-world assets." Still, there aren’t many projects that operate and are regulated in a manner similar to how European capital markets function.

To address this issue, BeToken aims to fill that gap. It works as a regulated security token tied to shares of Beself Brands S.A., a Spanish business managing five consumer brands that sell their products in several European countries.

Let’s see why BeToken grabbed attention in Polygon's ecosystem, the business foundation behind it, and the next steps the team plans to take.

What’s BeToken?

BeToken makes a clear statement about its purpose. $BTK is meant to act as equity (ownership shares) in a functioning company, and not just as a utility token. Polygon describes it in the same way. BeToken represents recognized shares in Beself Brands, giving holders economic benefits and voting rights, which follow specific shareholder guidelines set by the project.

The project operates within the European regulatory framework. BeToken’s website states that $BTK is a regulated security issued under Spain's Law 6/2023 on Securities Markets (LMVSI). It is supervised by an approved ESI and listed with Ursus-3 Capital as an ERIR.

On the technical front, BeToken operates on Polygon PoS and uses ERC-3643, a token standard built to enforce permissions for real-world-asset tokens. This standard makes it possible to have checks for compliance and eligibility at the token level.

In simple terms, it allows the asset to be set up so that transfers occur in a way that matches the issuer’s required rules.

Why Polygon’s acknowledgment was a big deal.

BeToken didn’t just launch without notice. Polygon put out an article calling BeToken Spain’s first regulated and on-chain Security Token Offering and highlighted it as an important moment for tokenized equity in Europe.

Sandeep Nailwal, the CEO of the Polygon Foundation, who also supported BeToken on his X page, highlighted BeToken as a working example of European tokenization taking place on Polygon PoS.

Why should this catch our attention beyond just marketing?

When a leading network showcases a project tied to regulated equity rather than experimental DeFi projects, it shows that the chain is aiming to be recognized as serious infrastructure for real-world capital markets and issuing assets. Polygon is being very clear here. They are not calling this a trial or a small test. They are describing it as an actual live equity issuance happening on the blockchain.

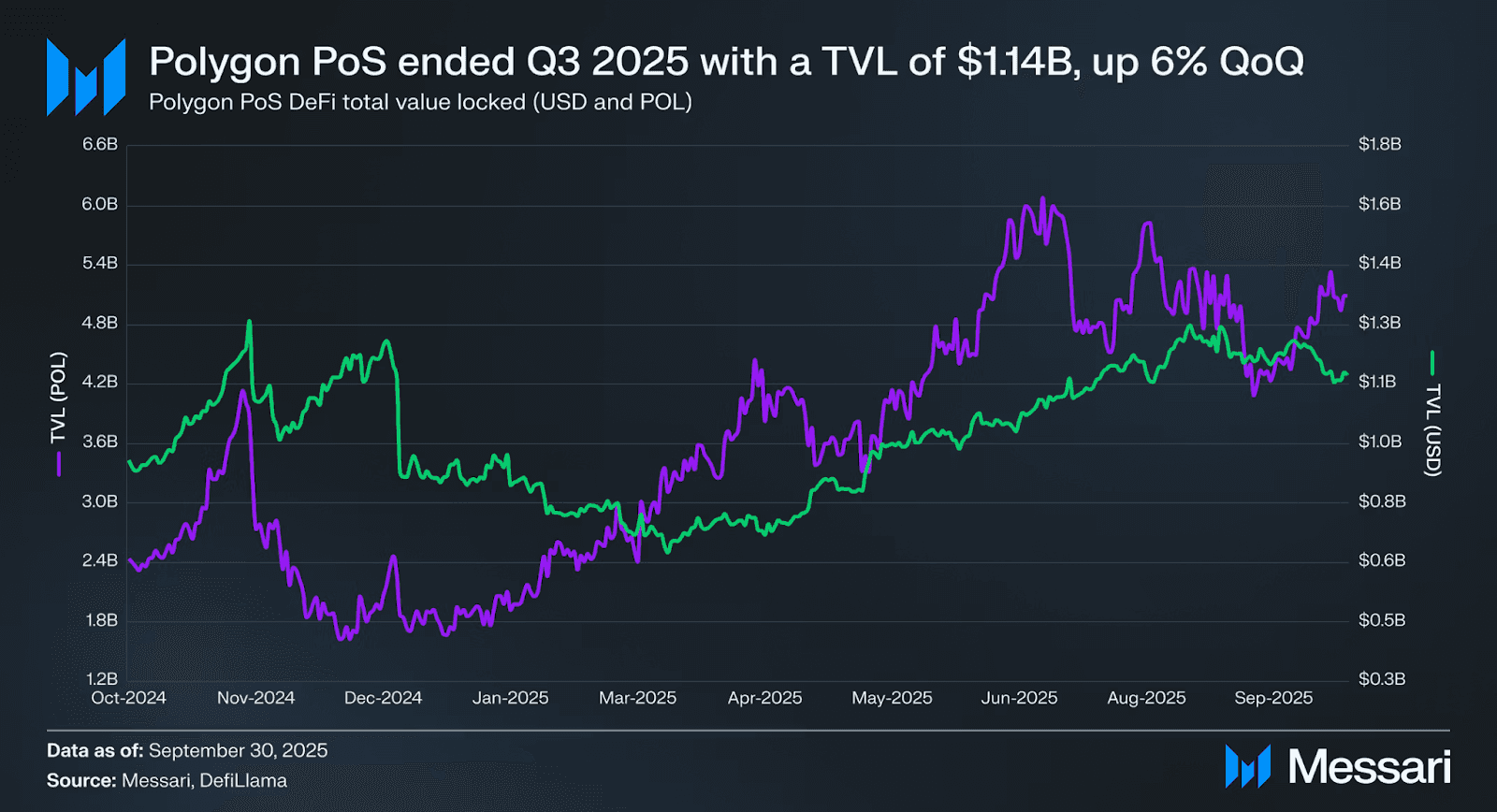

A "third-party signal" plays an important role here. The State of Polygon Q3 2025 report from Messari highlights BeToken as one of the institutional issuances helping Polygon PoS grow in the area of real-world asset tokenization.

You might not buy into every story tied to RWAs, but this shows one thing:

BeToken is being tracked as a part of Polygon's larger RWA developments, alongside other similar issuances.

What’s behind Beself Brands?

Many tokenization efforts face a tough question: "What’s backing the token?"

Here, the company in question already operates. According to BeToken’s materials, Beself Brands manages a 15,000 m² facility, has a workforce of around 60 employees, sells products in 10 European countries, and achieved €21M revenue in 2023.

Beself’s lineup consists of five consumer brands, each fitting into well-known product categories:

FITFIU (home fitness equipment): offers easy-to-use products for training at home.

Greencut (garden machinery and DIY tools): features products designed in-house, boasting patented engineering.

McHaus (home furniture, décor, and accessories): offers useful home products sold on marketplaces popular in France and across the EU markets.

Beeloom (kids' furniture and educational toys): centers on Montessori-inspired items expanded with help from expert partners.

Playkin (electric ride-ons and outdoor toys for children): emphasizes familiar designs with better quality.

BeToken shares a valuation overview for every brand, adding up to a total of €23,365,900 across all five brands.

These valuations are presented with specific context and assumptions. Including them serves to explain how the project approaches ownership. It’s an organized portfolio with clear reference points.

What has BeToken achieved so far?

BeToken’s success is not just about launching a BTK token.

A big step here is structural. Polygon calls BeToken an STO recognized by current Spanish law. It operates under CNMV's watch, with compliance and settlement happening on-chain using ERC-3643. This detail matters because it shows that tokenized shares can exist within regulations instead of staying outside of them.

On the business front, Beself has seen steady growth over time. BeToken’s website shows a detailed timeline covering years of progress. It highlights company milestones, from early online marketplaces to expanding with multiple brands and growing warehouse operations, leading up to this token launch.

It highlights its revenue jump from €300K back in 2008 to €21M by 2023, which equals about a 70× growth in fifteen years, or an estimated 39% annual growth on average.

Apart from revenue, the project points to other key success markers. These include expanding sales into multiple countries, having a solid logistics setup, and functioning as a multi-brand business. This approach is crucial because many tokenization efforts fail to tie blockchain features to actual business results. In contrast, this project builds its story around real and measurable business factors.

This mix of an operating company, a regulated framework, and an on-chain version sets BeToken apart from many other token launches, which often rely on community stories to drive them.

How does participation work?

BeToken often talks about the concept of “Ownerocracy,” highlighting that token holders are viewed more as active owners than passive bystanders.

The model they present includes a structure for governance and transparency that involves:

Quarterly updates on KPIs like sales, cash flow, forecasts, and EBITDA

Twice-a-year live Q&A sessions with leadership

Opportunities to vote on key business decisions, no matter the size of holdings

The mechanics for alignment also include a limit on founder sales. Founders restricted their own sales to 10% of their holdings for four years following the initial token sale. Although this doesn't remove risk, it is described as a structural measure to ease worries about rapid insider sell-offs.

Roadmap and Plans.

Instead of listing numerous initiatives, BeToken lays out a detailed roadmap split into phases spanning several years.

The brief explains a three-phase approach planned to take six years.

Phase 1: The company plans to grow in France and Italy while bolstering operations in Germany. It aims to increase sales from €22.9M in 2025 to €31.2M within the first year.

Phase 2: Efforts will focus on boosting profit margins by prioritizing direct-to-consumer sales instead of relying on marketplaces. The target is €48.3M by the third year.

Phase 3: The UK plans to enter the market and aims to reach €95.8M by year six. The goal focuses on achieving 30% annual growth between 2025 and 2031. They also aim to raise the EBITDA margin from 2.3% to 12.1% by adjusting operations and increasing scale.

The materials explain a planned policy to share profits starting in 2027, with 50% of distributable profits set aside for this purpose. They also highlight a loyalty reward condition connected to profits in 2025. The project narrative presents these as intended plans linked to execution.

Conclusion.

BeToken stands out as more than just launching a token. It represents an effort to combine regulated equity, transparent blockchain data, and real business performance into one model that people can follow over time.

The project’s foundation rests on key elements highlighted in its documentation. These include a structured method to manage tokenized ownership, an actual portfolio of European consumer brands with clear operating metrics, a strong presence via the Polygon ecosystem, a governance setup focused on openness and involvement, and a plan broken into achievable stages instead of uncertain claims.

To understand how tokenization is progressing in Europe, BeToken shows how “on-chain finance” can shift from being an abstract idea to practical solutions. It works within existing business and regulatory limits while utilizing blockchain technology to ensure openness and ease of access.