How to Launch a Token in 2026: A Complete Marketing Framework

Eight out of ten tokens launched last year are now worth less than what early buyers paid. The median drop is over 70%.

Crypto isn't what it was in 2020. Back then, you could ship a smart contract, land an exchange listing, and ride a wave of speculative momentum all the way to your target raise. That playbook is dead. What replaced it is harder, more expensive, and, if you get it right, far more durable.

If you want to launch a token in 2026, it means you're walking into a room full of skeptics:: institutional investors who've been burned before, regulators who are finally paying attention, and communities that have seen enough rug pulls to distrust nearly everything. Instead of selling a vision, you need to prove one.

And yet the ceiling has never been higher. Blockchain revenues are on track to hit $90 billion by 2030. Tokenized real-world assets could represent over $10 trillion in value within the decade. Solana alone hosts 85 million tokens. On any serious blockchain, proper preparation now runs three to six months, with launch costs ranging from $500 to well over $200,000 depending on complexity.

Most projects skip steps, and that's why most of them fail. This guide walks through the framework that separates the ones that don't.

Audience, Narrative, and Tokenomics

A successful token launch stands on three pillars: you must understand your audience, create a compelling story, and build sustainable tokenomics. These elements determine whether your project runs on success or joins the failed majority.

Segment your audience

"Retail investors" or "the DeFi community" are outdated ways to describe your audience. Your audience segments should reflect their behavior and motivation in these areas:

Capital Profile: Retail users, whale funds, builders, yield farmers, and speculators

Risk Appetite: Conservative, opportunistic, high-risk

Motivation: Yield, governance influence, access/status, speculation, ecosystem alignment

On-chain data helps you spot conviction buyers who accumulate despite price drops, momentum buyers who purchase during uptrends, profit takers, and first-time buyers. This behavior-based grouping shows investor psychology and helps you craft targeted messages.

Compelling narrative for different user types

Your token must solve real problems, but each segment needs its own story:

Retail audiences connect with tangible benefits, what the token does for them.

Institutional audiences care more about economics, lack of supply, and network effects.

Good stories create emotional bonds through personal experiences and interactive content. You should finalize your story 90 days before TGE. Then spread it through founder content, media appearances, and educational materials consistently.

Design tokenomics

Tokenomics extends beyond allocation charts and vesting schedules. A detailed model has token purpose, economic model, value creation, incentive design, and governance architecture.

Match rewards with value creation. Incentivize real engagement like staking, swapping, lending, and governance. Your vesting schedule should show your team's dedication, while community allocations must back up marketing claims about decentralization.

Note that exchanges care about two things: product traction and community size.

‼️Define your core metrics early and build your growth strategy to show genuine user interest.

Pre-Launch: Community, Content, and KOLs

Your token launch needs a strong community behind it. The groundwork starts months before the launch. A smart pre-launch marketing strategy creates momentum that flows through your token generation event (TGE) and beyond.

Phase your community growth: alpha, beta, public

Successful crypto communities don't appear overnight - they grow in clear phases. The best results come from this progression:

Alpha phase (500 members): A handpicked group of early believers, technical users, and partners gets direct access to the team. This closed testing gives crucial feedback and helps spot future community champions.

Beta phase (5,000 members): The community grows to include ambassadors and ecosystem partners and to test management systems. This controlled expansion builds your Minimum Viable Community to verify your product.

Public phase (10,000+ members): The doors open with tiered permissions and strong moderation. Well-structured channels make a difference, announcement-only spaces cut through noise while role-based access rewards active members.

Educational and narrative-driven content

Trust comes from education, not hype. Your community should see weekly updates through AMAs, newsletters, and video explainers. The focus should stay on explaining your token's real uses in simple terms. Remember, if you can't explain it in 30 seconds, your message isn't connecting.

Vet and brief KOLs for authentic activation

Key Opinion Leaders increase your reach, but only with the right strategy. Start finding KOLs 60 days before TGE and get the full picture of their on-chain credibility, audience fit, and engagement quality. The best KOL campaigns work in tiers:

Macro KOLs (100K+ followers): Build legitimacy

Micro KOLs (10K-100K): Break down mechanics through detailed content

Nano KOLs (1K-10K): Reinforce messages and reach deeper into communities and convert.

KOLs do more than promote, they educate, build trust, and keep people engaged. Give them a solid brief on your story but let their authentic voice shine through.

Read more about KOL marketing: Crypto KOL Marketing in 2026: Strategy Tips

Launch Execution

Your token launch day needs perfect coordination between exchanges, communications, and metrics tracking. Good preparation matters, but execution determines whether your project succeeds or fails.

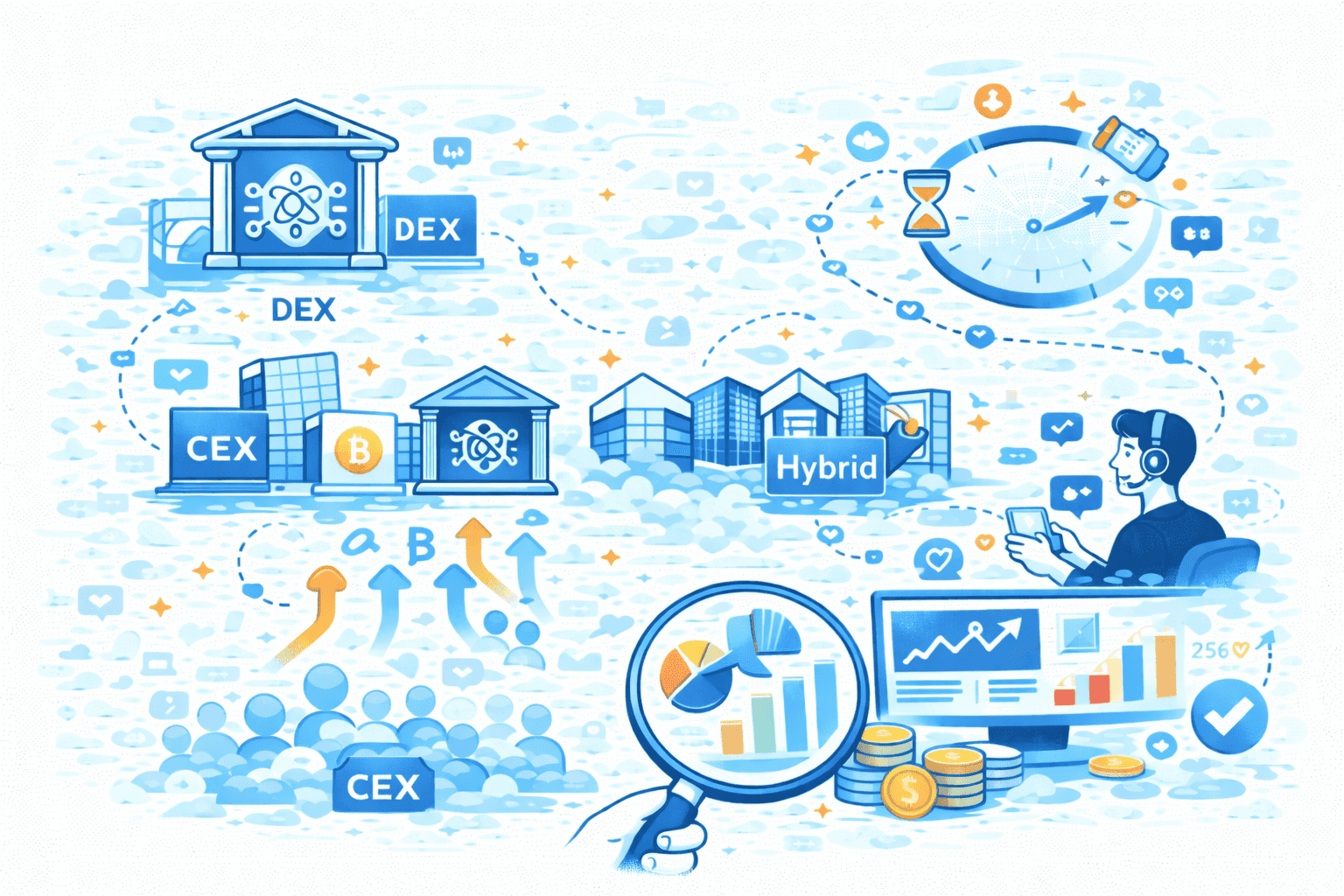

Choose between DEX, CEX, or hybrid listing

The exchange strategy you pick affects everything from liquidity to user acquisition:

DEX-first approach:

Pros: Immediate listing, permissionless access, lower costs, full control over listing details

Cons: Higher price volatility, lower initial liquidity, fewer retail users

Best for: Early-stage projects, community-driven launches, rapid market testing

CEX-first approach:

Pros: Higher liquidity, retail accessibility, institutional access, price stability

Cons: High listing fees ($100K-$1M+), strict vetting, longer timelines (60+ days)

Best for: Projects with institutional backing, sufficient funding, mass-market positioning

To get the best results you can use a hybrid approach. Launch on DEX for immediate liquidity, and follow up with CEX within 30 days. Note that listing should not be done just because it seems like the next step. A well-laid-out decision framework helps ensure your treasury can handle listing costs without affecting operations.

Plan hour-by-hour launch day communications

A coordinated launch creates excitement, not chaos.

Here's an example with a suggested timeline (12pm UTC launch):

9am-11am: Countdown threads from founders and partners

11am-12pm: Live AMA or Twitter Space with team + Reignite best performing KOLs to reinforce the audience attention

12pm: Token goes live, press release distributed, all social channels activated

12pm-2pm: Up-to-the-minute community management, milestone celebrations

2pm-6pm: Staggered partner tweets, educational content

6pm onward: Sustained engagement, daily updates

Timing and synchronization matter deeply. A press release before social posts loses momentum.

Metrics to measure success

These KPIs matter more than vanity metrics:

Wallet-to-user conversion (connected wallets vs. active users)

Active community members (governance participants, not just Discord joiners)

Staking/usage rates (percentage of supply being used)

Post-launch retention (holders after 1/7/30/60/90 days)

Sell pressure vs. lock-ups ratio (sustainable unlocking schedule)

These numbers help you learn about user engagement and token utility beyond the initial excitement.

Post-Launch Retention

Your token's future depends on post-launch retention. Many founders celebrate their listing day, but the real work starts when the first wave of excitement dies down.

Activate staking, governance, and ecosystem rewards

Staking creates demand by giving rewards to long-term holders. You should set up a governance staking model that lets users lock tokens to help make decisions. This creates utility and reduces circulating supply.

The best staking contracts need three main parts:

A secure vault to track balances.

A voting power calculator.

A reward distributor.

Users should earn ecosystem rewards through meaningful participation, not just holding tokens. Research shows that major proof-of-stake networks gave out more than $15 billion in staking yields in 2024.

Design seasonal quests and XP systems

Quest systems need active participation, unlike traditional airdrops. These game-like experiences turn passive holders into active contributors through challenges. You should also think about adding an XP (experience points) system before the full token release. This recognizes community contributions without promising quick financial gains.

Quest tiers with daily, weekly, and seasonal structures keep users involved.

Track KPIs

On-chain retention tells you more than just counting holders. You need to watch both Activity Retention (regular transaction participation) and Holder Retention (continued asset holding). These measure different ways users stay involved. Token velocity shows how fast tokens move in your ecosystem. High velocity often means weak utility.

Key areas to watch:

How many wallets convert to staking

Token velocity patterns over 30/60/90 days

How many people join in governance

Structural inflow vs. outflow patterns

Conclusion

So, the 2020 playbook is retired. Shipping fast and listing early no longer survives contact with a market that demands real utility, regulatory awareness, and earned trust.

Every piece of this framework connects. Audience research feeds your narrative, your narrative shapes community strategy, community strategy informs your listing approach. Pull any thread and the whole thing loosens.

If your project is serious about scaling visibility and trust through KOL marketing, our team at Disence can help. As the leading Web3 KOL marketing agency, we specialize in ROI-driven KOL campaigns that consistently deliver measurable growth. With access to 1,200+ vetted KOLs across YouTube, Twitter, TikTok, and Telegram, we maintain 91% client retention rate, we know what it takes to make your campaign perform. Book a call with our team to start planning your next Web3 KOL marketing campaign today.

Note that success comes from sustainable growth metrics over time, not launch day excitement. Your ongoing strategy should focus on meaningful KPIs: wallet connects, staking rates, governance participation, and retention. Build for those numbers and the rest follows.